Interview

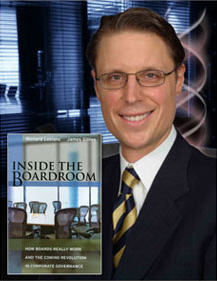

Richard Leblanc is a subject matter expert who is very adept at communicating; providing current and relevant content and context; and delivering with a style & technique that will leave audiences energized with inspiration & knowledge.

Richard Leblanc is a subject matter expert who is very adept at communicating; providing current and relevant content and context; and delivering with a style & technique that will leave audiences energized with inspiration & knowledge.

Richard Leblanc on Innovation from Inside The Boardroom

Q: What have we learned from corporate decision-making failure?

Whether it is the financial crisis, the BP catastrophe in the Gulf of Mexico, Enron or WorldCom, the causes include regulatory failure, boards not understanding the risks they approved, lack of shareholder stewardship, and management focusing on short-term profit that puts organizations and their stakeholders at risk.

you clearly have the experience to give us all valuable guidance.

‘must read’ for all concerned with corporate governance.

much needed alternative to the quicksand of conflicted self-serving metrics.

Richard Leblanc’s assessment model of boards of directors works and is leading edge.

‘Inside’ not only prophesies this change, but shows boards how to cultivate it.

only two or three rivals in the world in the subject area.

Q: How do we learn from this, and fix what occurred?

These crises are different because of the scope and depth of damage. There is a new normal now, in an environment characterized by curtailed credit, increased government and regulatory intervention, renewed inflationary fears, the swinging of the growth pendulum in favor of Asia, the rapid pace of change, increasing complexity associated with financial instruments, renewed focus on risk abatement/management, etc. To state the obvious, these developments are having a huge impact on governance.

Q: What are the governance changes?

Governments and standard setters are enacting or encouraging significant legislation in the areas of risk, compensation, sustainability and shareholder accountability; however, proactive change must come from within.

Dr Leblanc will:

- EXPLAIN what contributes to board and individual director effectiveness;

- SHARE successful best governance examples in risk, compensation, strategy & disclosure;

- SHOW how all facets of board effectiveness can be implemented in your organization.

Q: How do shareholders and boards exert their influence?

Both can have a profound effect on organizational performance. Great care should be devoted to selecting the right directors. Shareholders will no doubt influence this more and more, but the quality of the people around the table, and how they are led, receive information, make decisions, and oversee management, are all designed. Much of this performance is invisible to outsiders, but matters greatly.

Q: How should boards strengthen their governance practices?

Continuous improvement, disclosure, accountability, leadership, competency, and the capacity and willingness to challenge.

Q: How important is board leadership?

It is the most important contributor to board effectiveness, in my view. Empirically however, we know that separating the role of chair and CEO per se does not contribute to a more effective board or performance for shareholders. Industry knowledge and leadership skills of the chair are more important.

For an interview with Richard Leblanc, please contact him at rleblanc@boardexpert.com, or at 416-767-6676. Please click here for more contact information.